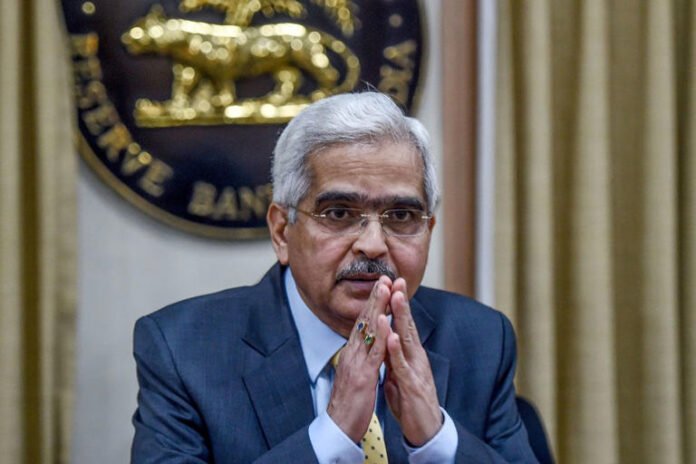

Reserve Bank of India (RBI) Governor Shaktikanta Das has issued a caution regarding a potential spike in inflation for October 2024, suggesting that the central bank remains alert to take necessary measures. Speaking at a recent event in Mumbai, Das emphasized the “significant upside risk to inflation,” indicating the RBI’s readiness to respond to any sustained inflationary pressures before revisiting interest rate adjustments.

- Inflation Outlook: Das highlighted that October inflation is expected to be higher than in previous months, building on an unexpected inflation surge in September. This rising trend has raised concerns about enduring price pressures across the economy, necessitating continued vigilance.

- Interest Rate Policy: Although the RBI recently shifted to a more neutral stance on monetary policy, Das dismissed the likelihood of an imminent rate cut. He stated that a rate reduction at this stage would be “very, very risky,” with inflation currently around 5.5% and projected to remain elevated in the near term.

- Global Context: Das’s comments reflect a measured approach amidst global trends of central banks easing monetary policies. He clarified that the RBI’s policy decisions would be based on India’s economic conditions rather than blindly aligning with global easing trends, underscoring the need for cautious action.

Future Actions and Considerations

Das reiterated that any future monetary policy adjustments will rely heavily on incoming data and an assessment of inflation over the next 6–12 months. He stated that a rate cut would only be considered once there is greater confidence that inflation can sustainably align with the RBI’s target of 4%.