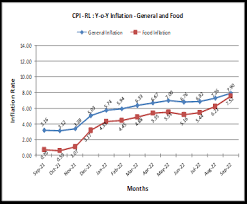

India witnessed a sharp rise in inflation in September 2024, with the annual rate climbing to 5.49%, up from 3.65% in August. This marks the highest inflation rate of the year, surpassing market expectations of around 5% and exceeding the Reserve Bank of India’s (RBI) target of 4%. The price surge, particularly in essential commodities, has raised concerns about the impact on household budgets and potential shifts in monetary policy.

One of the primary factors driving this inflation spike was a sharp increase in food prices, which saw an annual jump of 9.24%. As food makes up nearly half of the consumer price basket in India, this surge had a significant impact on the overall inflation rate. Notable increases were observed in:

- Vegetables: Prices skyrocketed by 35.99%, marking the most significant contributor to the inflation spike.

- Pulses and Products: Registered a 9.81% increase, further adding to the inflationary pressure on household staples.

- Housing Costs: Inflation for housing also saw a moderate rise, reaching 2.78% compared to 2.66% in August.

- Fuel and Light: While fuel prices continued to decline, the rate of decrease slowed to -1.39%, compared to -5.31% in August, contributing less to counterbalance the food price surge.

Urban vs. Rural Inflation

Inflationary pressures also varied across regions, with rural areas experiencing higher inflation than urban regions.

- Rural Inflation: Recorded at 5.87%, reflecting stronger price increases in food and other essential goods.

- Urban Inflation: Lower at 5.05%, indicating different cost pressures and possibly more resilience in urban areas.

Implications for Policy and Households

The sharp rise in inflation is expected to have a significant impact on consumer purchasing power, especially in rural areas where food constitutes a larger share of expenses. With inflation now exceeding the RBI’s target, the central bank may face pressure to reconsider its monetary policy stance, potentially revisiting interest rate decisions to curb inflationary pressures.

This inflation surge highlights ongoing challenges in managing India’s food supply chains, which have been affected by seasonal factors and weather disruptions impacting agricultural output. With the festival season approaching, further inflationary pressure may continue to strain household budgets, prompting both consumers and policymakers to stay vigilant.